Implementing financial psychology to support the human-side of financial planning.

Beyond the Plan® is elevating how financial services are delivered. From client conversations to firm-wide strategy, we provide behavioral finance solutions through training, consulting, and fractional leadership to drive clarity, confidence, and action.

Leading the change of an industry standard: Reimagining financial services with behavioral expertise that goes Beyond the Plan®

As our industry shifts, strategies alone are no longer enough. However, adding financial psychology into the mix allows trust to deepen, conversations to improve, and outcomes to strengthen—setting firms apart and leading impactful change across an industry. Our goal is to see behavioral expertise embedded into every organization to help leaders scale impact, advisors deliver with confidence, and clients to feel supported Beyond The Plan®. But how do you take financial psychology, implement it, and make it a practical process? With our complete coverage service model:

The Foundations Partnership

Firm Foundations

This is where behavioral expertise becomes the backbone of your practice identity. Every touchpoint in your firm, from how you onboard new clients to how you develop your team, will reflect a deep understanding of the human side of money decisions. Instead of consulting from the outside, we integrate into your practice as your Fractional Chief Behavioral Officer, becoming a collaborative partner who helps you build capability, confidence, and differentiation that compounds over time. This is comprehensive support designed to transform not just what you do, but how you show up for your clients and your team.

Advisor Foundations

Equip your advisors with the tools and confidence to navigate the emotional and behavioral side of client relationships. Through ongoing consultation and proven communication frameworks, your team learns to build deeper trust, reduce friction in difficult conversations, and improve client follow-through. The best financial plan in the world doesn't matter if it sits unimplemented. Let's ensure that the advice you deliver is advice your clients actually act upon.

Client Foundations

This tier connects your firm with on-call behavioral support through Beyond the Plan®'s network of financial therapists and behavioral specialists. When advisors identify situations requiring specialized intervention, whether it's navigating grief and financial transitions, working through family money conflicts, or addressing anxiety that's blocking implementation, your clients get direct support from credentialed professionals who understand the intersection of money and mental health. Access specialized expertise without hiring full-time behavioral staff, ensuring your clients receive the depth of care they need when traditional planning isn't enough.

The single most impactful decision we've made to level up our service was hiring Beyond the Plan® as our Fractional Chief Behavioral Officer.

Emily Rassam

Partner at Archer Investment Management

Our mission is to integrate financial psychology into the core of financial services—elevating firms, empowering advisors, and supporting clients.

Frequently Asked Questions

-

A: A Fractional Chief Behavioral Officer functions across three key dimensions: client-facing, advisor-facing, and firm-facing responsibilities. The role is centered on addressing client emotions, behavioral biases, and complex financial conversations while embedding psychology into planning and decision-making processes. By doing so, firms are positioned to strengthen relationships, improve outcomes, and enhance the overall client experience. For additional insights, a complimentary webinar is available here. For deeper insights and information watch our free webinar here.

-

A: Financial psychology provides a framework for understanding the emotions and behaviors that influence financial decision-making. When behavioral insights are embedded into advisory processes, stronger trust is fostered, transitions are navigated with greater clarity, and long-term outcomes are improved. This approach ensures that financial guidance extends beyond numbers to address the human factors that shape decisions.

-

A: Clients experience greater clarity, confidence, and emotional support when making financial decisions. With guidance from a specialist, sensitive topics such as wealth transfers, financial infidelity, and generational planning can be navigated more effectively. This leads to more productive conversations, stronger alignment with goals, and a deeper sense of connection throughout the planning process.

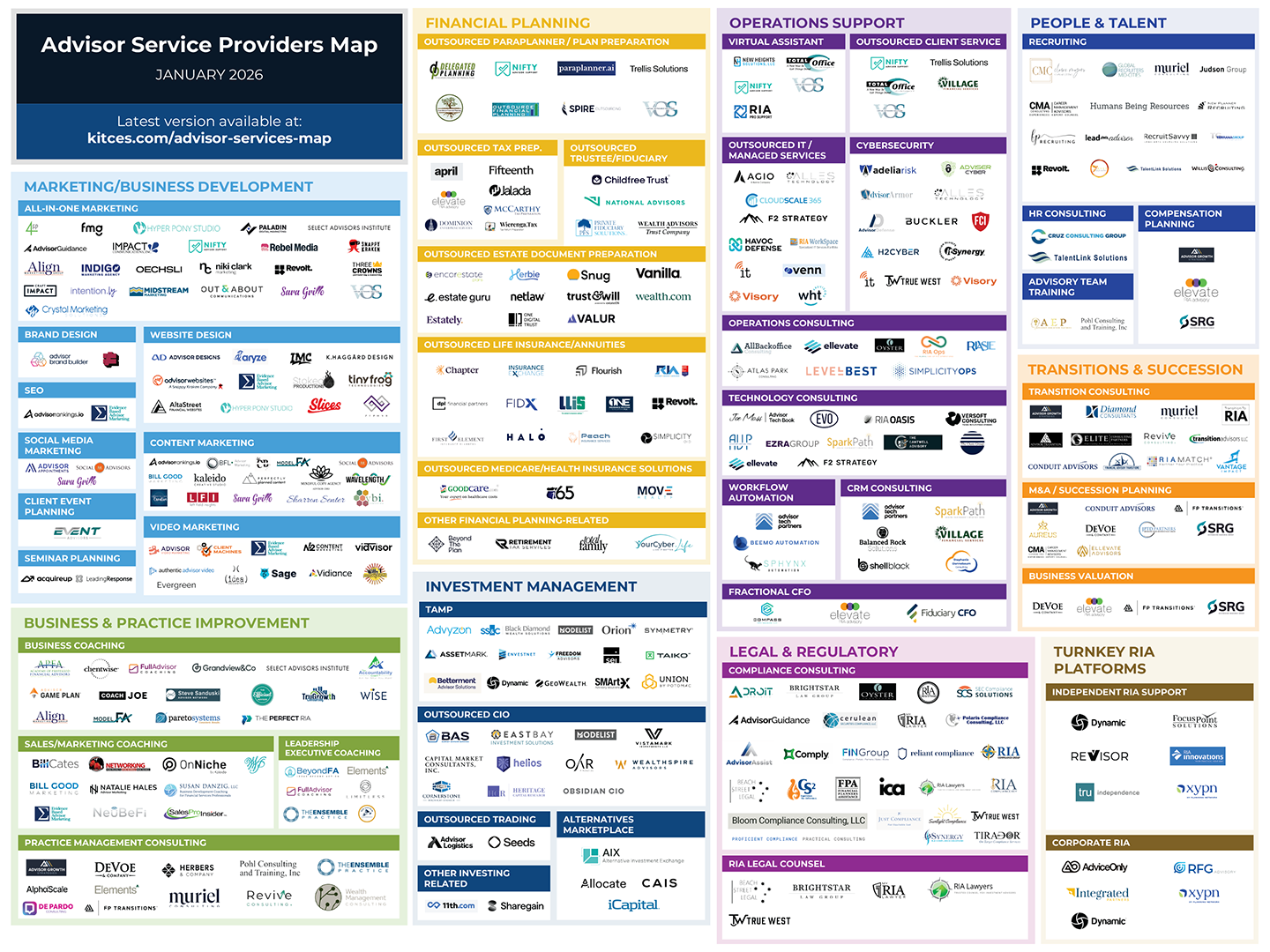

In 2026, we were included as a Recommended Advisor Service Provider and named a Top Financial Advisor Podcast.

We’re honored to be recognized with two distinct distinctions from Kitces — united by one shared commitment to advancing the financial planning profession.